26/01/ · This occurs fairly regularly when a TRIX indicator is used in day trading. A bullish divergence is created when the asset in question forms a new low (or lower low) but the indicator suggests a higher low — meaning a low price that is higher than the previous low The TRIX indicator is a versatile technical analysis tool that combines trend and momentum into one indicator. It is comprised of the rate of change of a triple exponentially smoothed moving average. The key signals generated by TRIX are divergences and signal line crossovers 05/11/ · The TRIX is a momentum indicator that can indicate an increasing or decreasing momentum. Crossing the zero line could be a buy or sell signal depending on the direction of movement. If the TRIX indicator crosses the signal line from bottom to top, it can be a buy blogger.comted Reading Time: 4 mins

TRIX – Standard Momentum Oscillator or Something More? | TradingSim

Al Hill : June 26, Last Updated: June 7, Alton Hill is a Cofounder at TradingSim. He has a passion to help people and found that one of his ways of doing so, is through the world of Day Trading. In this article, I will cover the TRIX indicator and the many trade signals provided by the indicator.

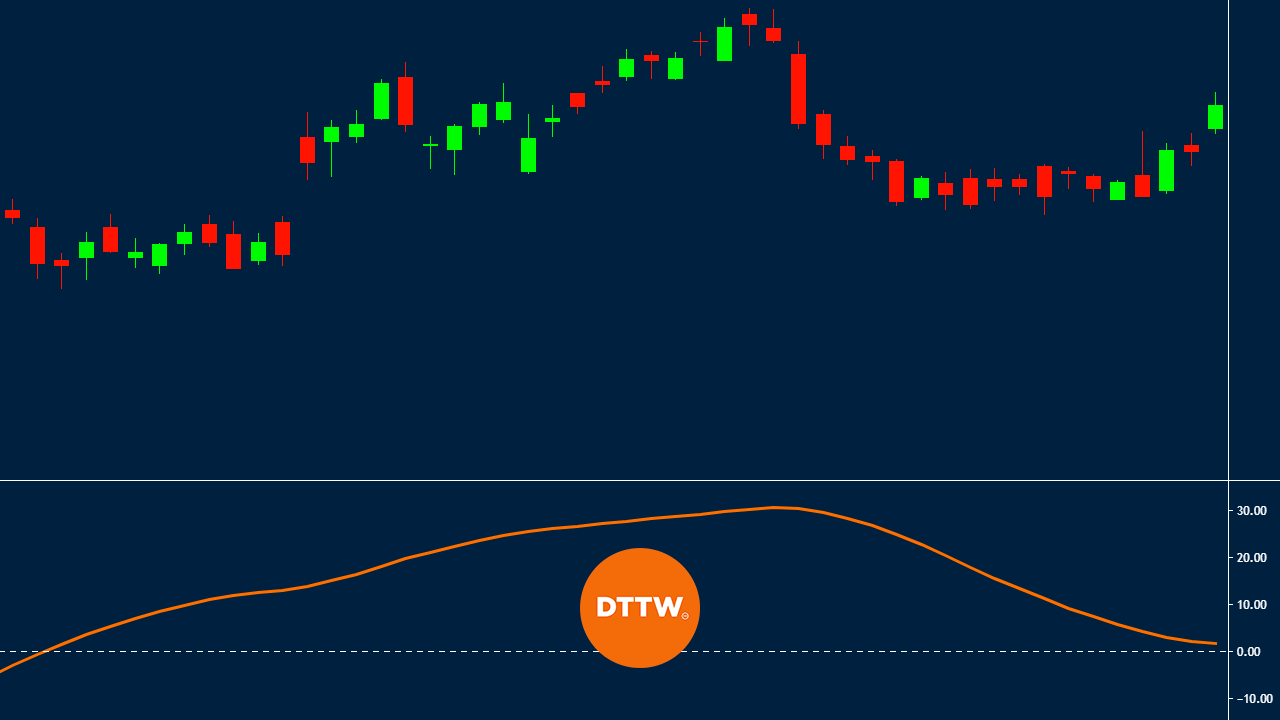

The TRIX is a momentum oscillator. The curved line of the indicator shows the percentage change of a triple smoothed exponential moving average. This is just a fancy way of saying each average is an average of the prior average, trix indicator day trading.

You then smooth them out to create one line — the TRIX. A cross of the zero line to the upside generates a buy signal. Conversely, a cross below the zero line generates a sell signal. This is a sure way to drain your account and make your broker rich, trix indicator day trading. In the above chart example, the stock DK crossed the zero line a number of times before the bottom was put in place.

This is where you want to wait until the indicator makes a significant bottom relative to recent swings of the indicator. You then enter trix indicator day trading buy order after the breach of the zero line. Now, here trix indicator day trading the tricky part, instead trix indicator day trading selling on the break of the zero line place your stop below the recent low before the cross up through the zero line.

This way you are relying on the price action for when to exit the position and not solely the indicator. The above chart example demonstrates the power of confluence between price and an indicator like the TRIX.

Notice how the backtest occurs as the price action is backtesting a 7-day price channel. You can see how trading with the indicator goes much further than simply buying and selling crosses of the zero line.

This is always a favorite go-to for any indicator. This occurs when the price action and indicator are not aligned which is a precursor of a momentum shift. Do you see how trix indicator day trading indicator puts in a retest of its lows, trix indicator day trading, but the indicator on the second test is above the zero line.

This ultimately leads to a massive run higher, where the indicator makes fresh new intraday highs on each push higher. The second high had a lower reading on the indicator, which is a precursor for a likely pullback. The TRIX indicator will have the same trouble as any other oscillator — range-bound trading. Once price action begins to coil the three EMAs that make up the indicator begins to overlap.

This creates a tight range in the indicator which will generate crosses above and below the zero line without a major price move. This is where momentum indicators get in trouble. Therefore, if a stock or market is not in an impulse trend move, the indicator begins to pump out false signals. Therefore, I wanted to take some time to perform a comparison of the TRIX indicator with price oscillator. The price oscillator is made up of the 12 and 26 EMA lines, so like the TRIX, the price oscillator relies on the EMA.

However, the price oscillator is slightly leading over the TRIX. So, if you want to lead price the PO will provide you the ability to jump the market over the TRIX. In short, the TRIX indicator is not the holy grail of oscillators. The indicator has its flaws but it also is able to provide extremes in price action. In addition, you can measure impulse moves relative to historical price activity. If you are interested in the indicator, you can use Tradingsim to practice trading with the indicator to determine if it is able to give you an edge.

Shares are units of equity stock and represent equity ownership in a company. The persons or institutions holding shares of a company are called Crypto crash and crypto winter are both terms used to describe a period of time when the prices of Facebook LinkedIn Twitter Youtube.

Trading Basics. Order Types Money Management Day Trading Salary The Pattern Day Trading Rule Stock Earnings Trading Patterns. Chart Patterns, trix indicator day trading.

Candlesticks Explained 6 Bullish Candlesticks 8 Bearish Candlesticks Doji Candlestick Double Bottom W Symmetrical Triangle Ascending Triangle Descending Triangle The Bear Trap The Golden Cross Head and Shoulders. Trading Strategies. How to Use Scans in Day Trading How to Trade the Head and Shoulders Strategy How to Create a Trading Plan Options Trading Guide for Beginners Trading Patterns.

More Education. Day Trading Blog The SimCast Podcast Stock Trading Indicators Trading as a Business Trading Psychology. Al Hill : June 26, Last Updated: June 7, Alton Hill is a Cofounder at TradingSim. Day Trading Indicators Momentum Indicators Oscillator Indicators. Table of Contents. Trix Cereal. Cross of Zero Buy Signal. Sell Signal. Higher TRIX Reading. False Signals. Price Oscillator Leads TRIX.

What Are Shares in Stocks? John McDowell : July 8, trix indicator day trading, Day Trading Basics Basics of Stock Trading. Pips in Forex Trading Explained John McDowell : July 7, Day Trading. Crypto Crash and Crypto Winter Explained John McDowell : July 4,

TRIX Indicator Explained

, time: 6:19TRIX — Technical Indicators — Indicators and Signals — TradingView

The TRIX indicator is a versatile technical analysis tool that combines trend and momentum into one indicator. It is comprised of the rate of change of a triple exponentially smoothed moving average. The key signals generated by TRIX are divergences and signal line crossovers There are several benefits of using the TRIX indicator. 1 - It is found as a default indicator in most trading platforms. This means that you don’t need to buy or download it from the marketplace. 2 - The method of calculating the indicator is relatively simple. It is much simpler if you know how to calculate the exponential moving blogger.comted Reading Time: 5 mins 30/09/ · Like most momentum indicators, the main job of the TRIX is gauging momentum where traders discern where it’s increasing or decreasing in value above particular points. Let’s dive deeper into the TRIX’s construction, advantages and disadvantages, and examples of how you can use it in your trading. Basic design and functions of the TRIX

No comments:

Post a Comment